The ECB has released a flood of data in the past couple of days. Here is some interesting stuff from the Bank's report on "Financial integration in Europe."

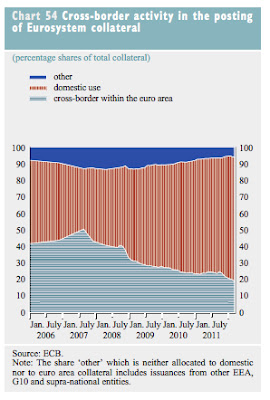

Chart 54 demonstrates the deterioration in cross border collateral posting in Eurosystem operations since the onset of the crisis. Cross border collateral posting occurs when a bank in one country, say Germany, buys a loan or security in another country, say Spain, and then finances it by accessing Eurosystem refinancing at the Bundesbank. From the ECB

A higher share of cross border collateral posted with the Eurosystem would suggest more cross border ownership in general. As the chart shows, cross border collateral posting has gone from over 50% of Eurosystem collateral to around 20% in 5 years - probably not a good sign for European financial integration.

No comments:

Post a Comment