There has been a rush in the U.S. to attribute the financial

crisis to a haircut spiral and a run on repo.

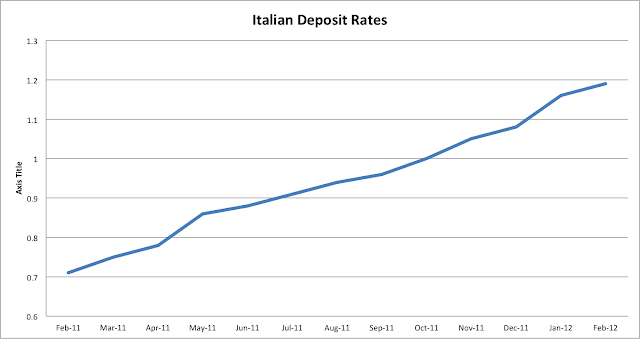

Without tackling that claim (which we believe to be false), it is

interesting to look at the balance sheet of Unicredit – a particularly stressed

Italian bank and how it has evolved from year end 2010 to year end 2011. One might therefore expect that the bank would be experiencing problems in repo financing.

But look at the following two charts (source: UniCredit 2011 financial presentation) UniCredit increased its repo borrowing across

the board, including a huge increase (almost 200%) increase in central bank

funding (and this is not including the 2nd LTRO). But private repo borrowing also increased 17%

on a gross basis and on a net basis (repo borrowing – repo lending) UniCredit increased

its funding from private repo by over

24 billion euros. This picture is in

line with some of the stuff I posted yesterday showing the increased preference

for secured liabilities over unsecured.

Some words of caution – the data is on a consolidated basis, and UniCredit obviously

has operations outside of Italy. As the ECB's VP Vitor Constancio admitted in a speech today on shadow banking, good data on repo is hard to come by.

.tiff)